Most Home Shopping Mail Order Catalogue Companies now offer Next Day Delivery, consequently this may cost more, but it is ideal when you are in a hurry for something. Add the items to your basket and remember to be sensible. Credit checks will need to be passed before you can place your first order. Credit 4 Everyone was created to give you, the consumer, a real understanding of how Pay Monthly Catalogues work. The Kaleidoscope Catalogue with Credit offers A layer of lace here, a splash of colour to catch the eye. Flava offers no credit checks, no hidden fees, or additional charges. Open your GuaranteedFood Shopping Credit account with Flava today. With Jacamo, you can spend hours trying on clothes that fit your body type and sense of style.

However, with a personal account, you have more flexibility. You can pay online via your phone, by direct debit, internet banking, or cheque. The online retailer allows you to spread so that you can pay in monthly installments. If you’ve stumbled upon this website, it is possible that you have bad credit history that prevents you from being accepted for the pay monthly catalogues. This article will show you how it is still possible to get approved for an online shopping catalogues even if you have a low credit score.

Top Bad Credit Catalogues In Uk

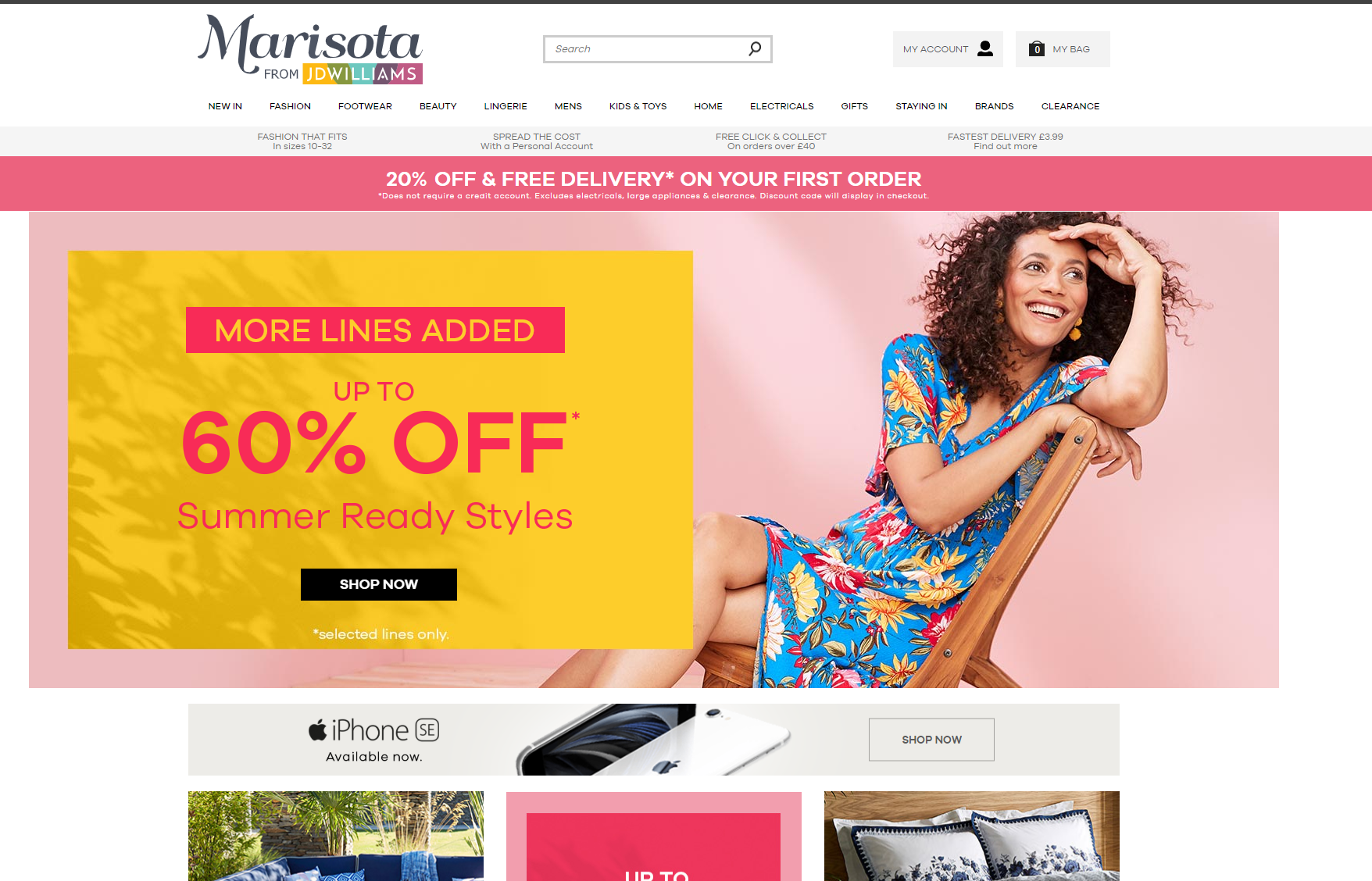

We have a portal for men who are plus-sized. Here’s the female counterpart. Marisota caters to women who simply look good in plus size dresses, skirts, trousers, and pretty much everything else under the sun. Way account is only available to UK residents aged 18 or over and is subject to status. You can choose to pay the minimum amount or more if it suits you. Take 14 days to try before you buy, in the privacy of your own home.

For generations, children have not been taught about financial products in schools. These generations now have children, which means that the cycle of poor money management continues. Once you have been approved for a catalogue you wont have to pay upfront fees as it is on a finance based term. It is advisable to honor your pledges as stipulated on the buy now pay later basis. It is worth remembering that this is a special facility that was accorded to you despite the fact that you have been badly listed elsewhere. Most catalogs will give you an immediate answer so yes, in some sense.

What You Need To Open A Pay Monthly Catalogue Personal Account

I think a DMP is a good option if you have complaints going through – it gets you into a safe financial space and if you win any complaints the DMP will be speeded up. Resolving to a new debt will not get you the interest removed. You still have to repay what was borrowed. You will not be able to win your case faster by using a claims company or solicitor. These complaints can be made if your account is still open, or if it is closed and settled, or it is with a debt collector. NB your affordability complaint should go to the original lender, not the debt collector. I would like you to refund me all the interest I paid and any late payment charges .

The interest rate on cash withdrawals from your credit card may be lower than the interest you pay on your catalogue. If you fail to pay the arrears or make your monthly payments on time, the account may default and you could face further action. The catalogue company could also add to the debt, by charging you penalty fees and administration costs.